Do You Pay Taxes When You Buy or Sell a Business?

Selling a business can be exciting and financially rewarding. It is often the culmination of decades of hard work and dedication. Business owners are und focused on maximizing the financial gains from the sale. Yet the end game should be not so much the price of the sale as the final take home, and one factor that can put a big dent in proceeds from the sale of a business is taxes.

Because the sale of a business can generate significant income, taxes will be assessed. How the deal is structured, however, will affect how much it is taxed. When selling a business, it is important to have a plan to minimize taxation and maximize proceeds. An experienced Naperville, IL attorney can provide advice on the tax implications of selling a business.

How Are You Taxed When You Sell a Business?

Selling a business triggers federal capital gains taxes. Capital gains taxes are taxes on the extra money you make when you sell the business for a higher amount than you invested in it. For example, if you started the business with $200,000 and sold it for $600,000, you made a $400,000 profit, which will be taxed.

The Internal Revenue Service (IRS) treats the sale of a business not as the sale of one asset but rather as the sale of each of all the assets of the business. For federal tax purposes, each asset is treated separately to determine whether the sale will be taxed as long-term capital gains or as short-term capital gains, which are taxed like ordinary income.

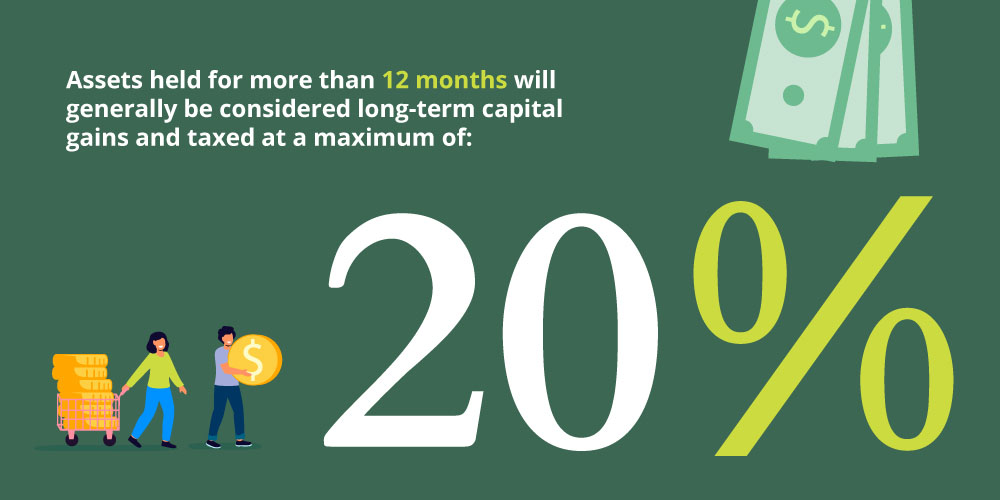

Assets held for more than 12 months will generally be considered long-term capital gains and taxed at a maximum of 20 percent, whereas ordinary income is taxed at the individual taxpayer rate, which can be much higher. Illinois also assesses a long-term and short-term capital gains tax in addition to the federal tax. In Illinois, capital gains are taxed at the same rate as income.

Additional factors also influence how the sale is taxed, including whether the sale is an all-cash or installment deal, whether it is a sale of assets or stocks, the corporate structure of the business, and whether the transaction can be treated as a merger rather than a sale.

Is the Sale an Asset or Stock Sale?

Whether the sale of a business is structured as an asset or stock sale can have taxation implications. In an asset sale, the transaction is structured as a sale of the company’s assets, whereas a stock sale is structured purely as a sale of stocks.

Sellers often prefer to structure the sale as a stock sale, which has a lower capital gains rate. Asset sales by contrast face higher taxes because assets are taxed as ordinary income rather than capital gains. On the other hand, buyers usually prefer to structure the sale as an asset sale, which will generally allow them to claim more deductions and save money.

How Does a Business Structure and Size Affect Taxation?

A company’s corporate structure can also affect how it is taxed when sold. Smaller companies tend to be structured as limited liability companies (LLCs), partnerships, and S corporations. These types of entities are taxed using pass-through taxation. That means that individual owners pay taxes but the company does not.

The sale of larger companies, which are often structured as C corporations, will have more complex tax implications. For example, a C corporation’s sellers may wish to sell company stock rather than assets to avoid double taxation of both the individuals and the company. Alternatively, a C corporation may find it advantageous to merge with another company instead, which can avoid taxes altogether.

What Are Common Terms of a Business Sale?

- Cash at closing: The buyer pays cash at closing. The seller will pay capital gains taxes on the year that the transaction is finalized. Sellers tend to prefer this form of payment.

- Earn out: The buyer pays part of the purchase price in cash, and the rest over a period of time dependent on whether the business meets certain milestones.

- Equity rollover: The seller agrees to reinvest a portion of their ownership in the company rather than getting cash. This can have tax benefits by deferring taxation.

- Seller’s note: In this financing method, the current owner of the business gives the seller a note to pay off part of the business purchase at a low interest rate, allowing the seller to attract a wider range of buyers who might not be able to pay the full purchase price upfront.

- Non-disclosure agreement (NDA): Used in the course of negotiations as both parties bind themselves to keep certain proprietary information confidential during negotiations.

How Can Structuring the Deal as an Installment Sale Affect Taxation?

By agreeing to receive payment for the deal in installments, a seller can defer paying taxes until each installment is received, and also charge interest to offset the taxation burden. This can be advantageous to sellers, but it comes with risks if the buyer is not able to make the payments for any reason, such as if the business is not doing as well as expected.

What About the Tax Implications of a Corporate Merger?

Sometimes businesses will choose to merge rather than sell the business. In a merger, no cash or assets are exchanged. Rather, the deal is an exchange of stocks and, if done properly, it can be structured to avoid taxation altogether while allowing the business to continue under different management.

Contact a Naperville, IL Tax Attorney

If you are selling your business, one of the main issues that will impact your take-home from the sale will be taxes. It is vital to put in place an effective strategy to minimize taxation from the sale of a business. The experienced Naperville, IL tax attorney at Gierach Law Firm is here to provide advice on the complex tax ramifications of structuring a business sale. Denise Gierach brings to her practice not only her extensive experience but also her education as a certified public accountant. Contact the firm at 630-756-1160 for a consultation.

Practice Areas

Archive

+2018

+2016

Please note: These blogs have been created over a period of time and laws and information can change. For the most current information on a topic you are interested in please seek proper legal counsel.